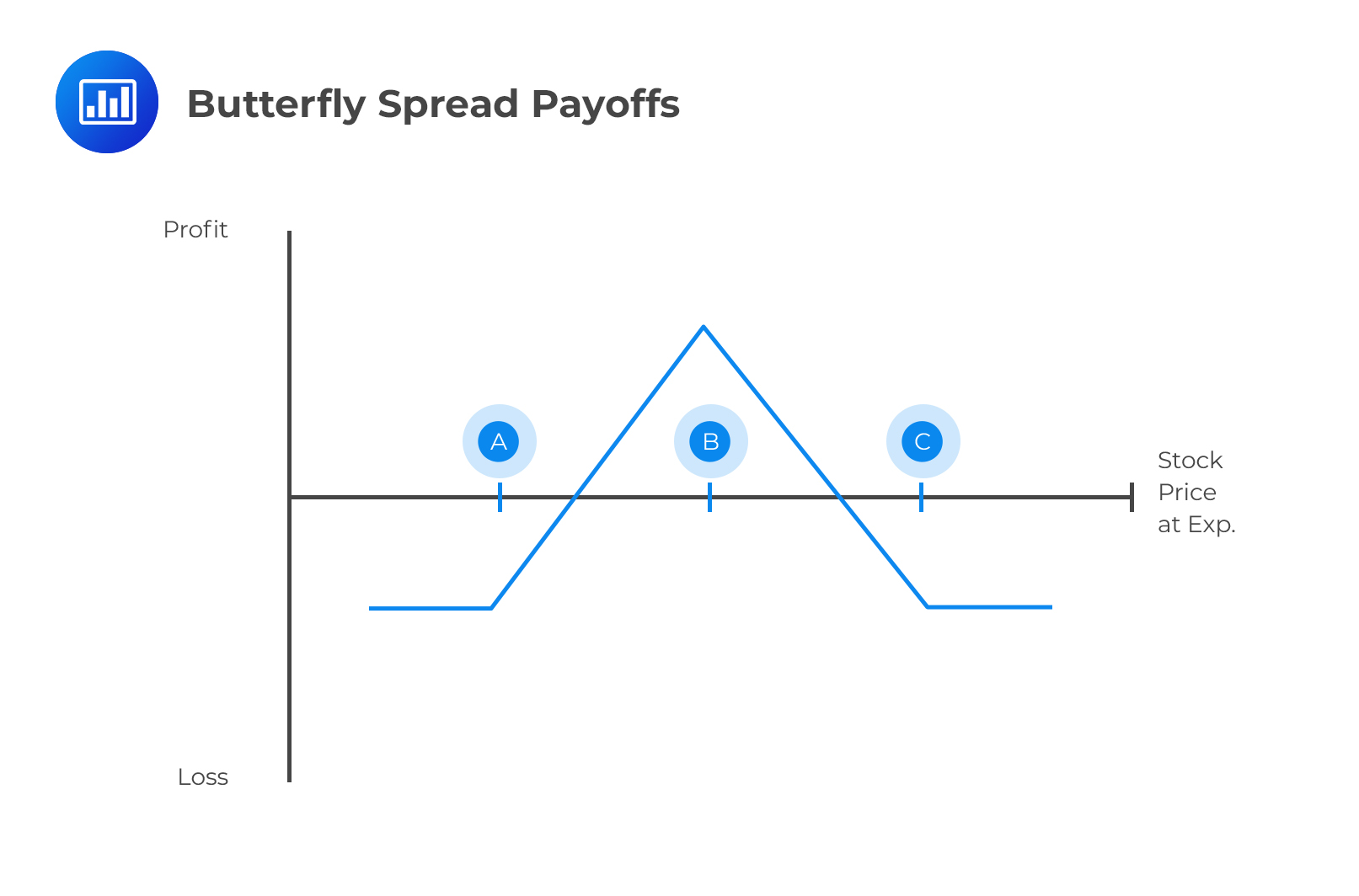

Butterfly Calendar Spread. In contrast to the butterfly strategy previously discussed, calendar spreads involve options that expire on different dates. Figure 2 displays the risk curves for an otm call butterfly.

The maximum profit is calculated as the difference between the short and long calls less the premium that you paid for the spread. A calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high.

The Butterfly Makes Money When Volatility Goes Down.

What is a butterfly spread?

If You Want To Use Calendar Spreads For.

The term butterfly spread refers to an options.

The Primary Goal Of This Strategy.

Images References :

Source: optionalpha.com

Source: optionalpha.com

How To Set Up a BrokenWing Butterfly Option Strategy, Calendar spreads are useful in any market climate. In futures trading, a butterfly spread is a trading approach that involves the simultaneous buying and selling of multiple calendar spread contracts.

Source: analystprep.com

Source: analystprep.com

Trading Strategies FRM Study Notes FRM Part 1 & 2 AnalystPrep, Let's compare and contrast an options butterfly trade and an options calendar trade. Neutral strategy with capped profit.

Source: www.amazon.com

Source: www.amazon.com

2019 Wall Calendar Butterfly Calendar, 12 x 12 Inch, If you want to use calendar spreads for. Butterfly is complex spread constructed over three different maturity dates/legs.

Source: www.calendarbuy.com

Source: www.calendarbuy.com

Best Butterfly Calendars 2022, A calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. We'll start by discussing how they compare and then move on.

Source: www.tradingview.com

Source: www.tradingview.com

ARKQ iron butterfly calendar spread idea for AMEXARKQ by growerik, Ultimately, utilizing this strategy is an effective way to minimize risk. Box spread (also known as long box) is an arbitrage strategy.

Source: www.petprints.com

Source: www.petprints.com

Butterflies Calendar 2020 Pet Prints Inc., It involves buying a bull call spread (1 itm and i otm call) together with the corresponding bear. Ultimately, utilizing this strategy is an effective way to minimize risk.

Source: www.pinterest.com

Source: www.pinterest.com

Pin by Suzanne Jordan on my school library Butterfly room, Classroom, Butterfly is complex spread constructed over three different maturity dates/legs. Calendar spreads are useful in any market climate.

Source: www.pinterest.com

Source: www.pinterest.com

2015 Butterfly Calendar Calendar, Calendar design, Art calendar, The maximum profit is calculated as the difference between the short and long calls less the premium that you paid for the spread. Ultimately, utilizing this strategy is an effective way to minimize risk.

Source: www.publicdomainpictures.net

Source: www.publicdomainpictures.net

2016 Monarch Butterfly Calendar 2 Free Stock Photo Public Domain, It makes its maximum profit at the center striking price, so one. Buy one june 16 rut 1710 put sell one.

Source: www.pinterest.com

Source: www.pinterest.com

2016 Butterfly CalendarBIG Calendar Big calendar, Calendar, Butterfly, Figure 2 displays the risk curves for an otm call butterfly. With fslr trading at about $130, the trade displayed in.

A Butterfly Spread Is An Advanced Trading Strategy That Involves Simultaneously Buying And Selling Multiple Futures Or Options Contracts.

In futures trading, a butterfly spread is a trading approach that involves the simultaneous buying and selling of multiple calendar spread contracts.

Butterfly Is Complex Spread Constructed Over Three Different Maturity Dates/Legs.

If you want to use calendar spreads for.